Here’s How Your Credit Score Affects Your Mortgage Rate

Often times, home buyers don’t really stop to think about how their credit scores could be impacting the rate they get on a mortgage loan. And taking it to the next level, they rarely consider how that rate will truly affect the amount of money that “pours” out of their pocket for the next 5, 10, or even 30 years!

The reality is that people with lower credit scores are usually so thrilled that they qualify for the loan, they don’t realize the impact of the higher interest rate.

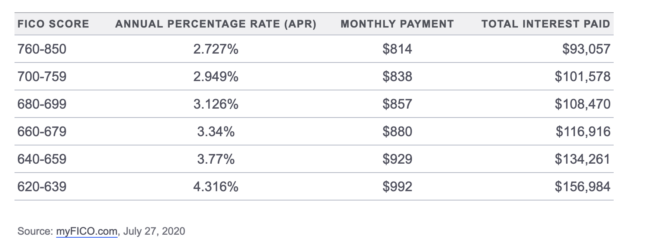

Take a look at this chart below from myFiCO.com, where they looked at mortgage rates, credit scores, and total interest paid over the life of a $200,000 loan:

As you can see, an individual with credit scores in the 620-639 range could pay over $60,000 more in interest than an individual with top tier credit – and this is only for a loan of $200,000! In many areas of the country, loan amounts are significantly higher than this to you could double or even triple these numbers in some cases.

A simple investment of a few hundred dollars with Dedicated Credit Repair can potentially save a borrower with poor to average credit hundreds of thousands of dollars.

If you’re a home buyer, this is worth every penny. If you are a Realtor or lender, you can cement a client relationship for life by explaining to them why the credit repair process is well worth their time and small investment.

Got questions or need additional information? We’re always willing to help! Call our office for a free consultation.