When NOT to Use Your Debit Card

How often do you use your debit card? Do you use it when you travel? Do you use it in places such as gas stations, convenience stores, for online purchases, or anywhere that may have “less than optimal” security measures in place? One of the risks of not having a few credit cards available for…

What is a Good Credit Score?

These days, your credit score influences more than you might think. Most of us tend to think of credit scores when we are planning to buy a home or a car. But your credit score can influence some surprising aspects of your life, such as your car insurance rates or even your job prospects! And,…

I Can Afford to Pay Off My Car… But Should I?

This advice sounds crazy to many people… Don’t pay off your car if you are trying to build up your credit scores. “But why? Isn’t paying off debt a good thing?” Well, under normal circumstances, yes, paying off debt is a good thing. However, when you have an installment loan on your credit report that…

Why Do I Need to Have Some Credit Card Debt to Have Good Credit Scores?

This might surprise you, but credit scores were was not created for your benefit. The credit card companies, banks, and lending institutions would not prosper if each of us used our credit lines and paid them off in full every month. Creditors charge interest and that’s how they make their money. They make the most…

Are You “Leasing” Equipment from Your Cable or Satellite Provider?

If the answer to this question is “yes” then please take notice… When you have any type of monthly service subscription that requires that you lease equipment (such as cable boxes, modems, etc.) be certain to: Take a picture of yourself returning the equipment. Take down the name of the employee that took your equipment…

Need Mortgage Relief? Here are 5 Steps to Follow

Has the Coronavirus pandemic made it difficult, or even impossible, for you to make your mortgage payments? Watch this video for information on the steps you should take with your mortgage company to try and receive forbearance. One IMPORTANT thing to note, however: Forbearance does not mean loan forgiveness and it will almost certainly have…

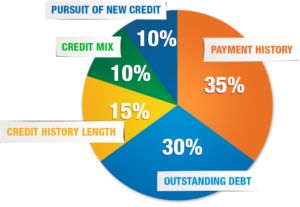

How is Your Credit Score Determined?

Too often, people will incorrectly assume that they can have great credit scores simply by paying their bills on time and “not owing money” to anyone. Your payment history and your outstanding debt are definitely important, but they only make up about 65% of your credit score. It’s also important to have a long,…

Should I Pay Off My Credit Cards?

Believe it or not, my advice is no. Many credit card companies are going to be decreasing credit limits and or closing credit cards on consumers to minimize their “at risk” level of exposure. If you gently pay down your credit cards to a 25% usage amount you will be less at risk for a…

Debt Collectors MUST Follow These Rules…

Did you know Debt Collectors MUST abide by the Fair Debt Collection Practices Act? Debt collectors have rules that they must follow. We all know that we are responsible to pay our debts. If you fall behind on paying your debts however, you may be contacted by debt collectors. These debt collectors have rules that…

Does It Matter If the Status Of My Derogatory Account is “Open” or “Closed”?

It really doesn’t matter if an account remains open or closed. A late/missed payment will impact your credit score regardless of the status of the account. Many consumers contact our office under the false impression that their late payments on closed accounts do not have as big of an effect on their credit scores. That…